The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained. Backtested performance is not an indicator of future actual results.

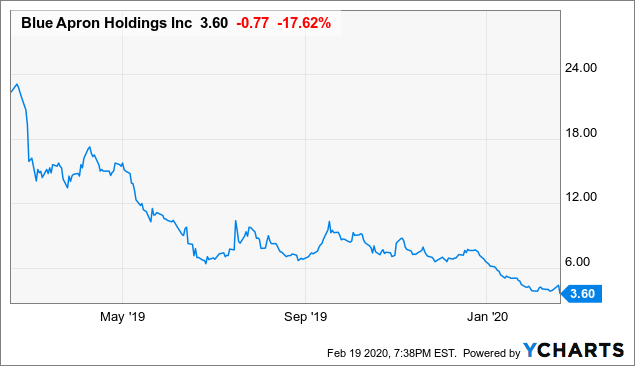

If the company misses the mark again, the stock could fall below $1.Disclaimer: The TipRanks Smart Score performance is based on backtested results. Beating those numbers would be a sign to investors that the company is on the right track, and new CEO Brad Dickerson's strategies are taking hold.

A pullback in marketing following operational errors last year has caused revenue to fall sharply this year, and analysts are expecting revenue to decline 25.4% to $157.2 million in the third quarter, but also see its loss per share narrowing from -$0.47 to -$0.22. With its third-quarter earnings report coming out next week, Blue Apron desperately needs to show progress in returning to growth. Though the deal is unlikely to move the needle for Blue Apron since it only serves one region of the country, it opens the door to potentially selling in Walmart stores, as Jet.com is a subsidiary of the retail giant. However, toward the end of the month Blue Apron got a much-needed boost from a new partnership with Jet.com, which became the first online retailer to sell Blue Apron meal kits, offering same-day delivery, but again only in the New York area. Blue Apron continued to swoon in the following weeks, hitting an all-time low at $1.02 as the stock was pressured by the market rout.

0 kommentar(er)

0 kommentar(er)